Shared: San Francisco Bay Area Apartment-Building Market Report (Paragon Real Estate)

Updated by Paragon Commercial Brokerage

San Francisco Bay Area

Apartment-Building Market Report

May 2014 Update by Paragon Commercial Brokerage

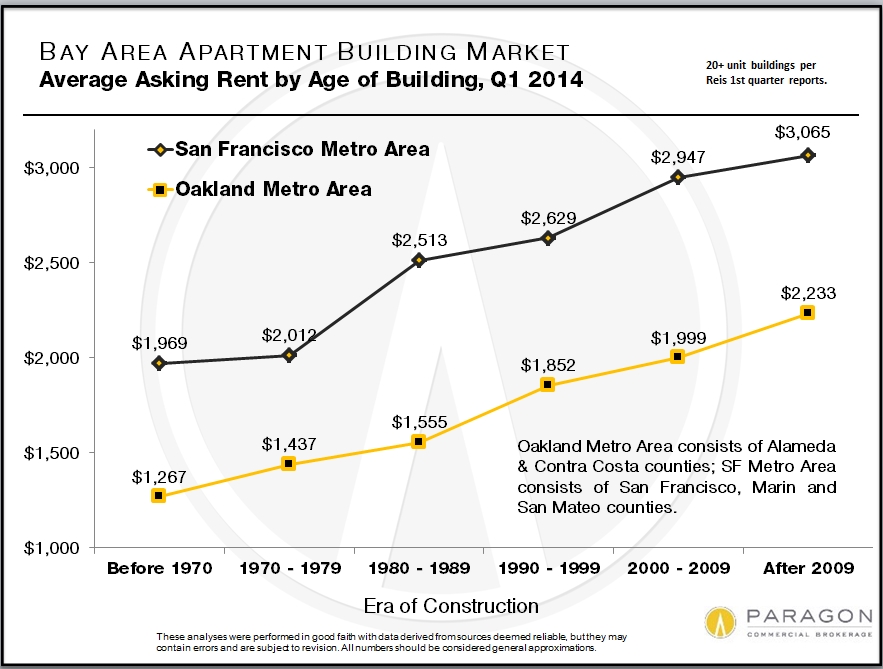

In this report, San Francisco Metro Area refers to San Francisco, Marin and San Mateo counties, with 138,600 existing apartment units; Oakland Metro Area refers to Alameda and Contra Costa counties, with 147,300 units.

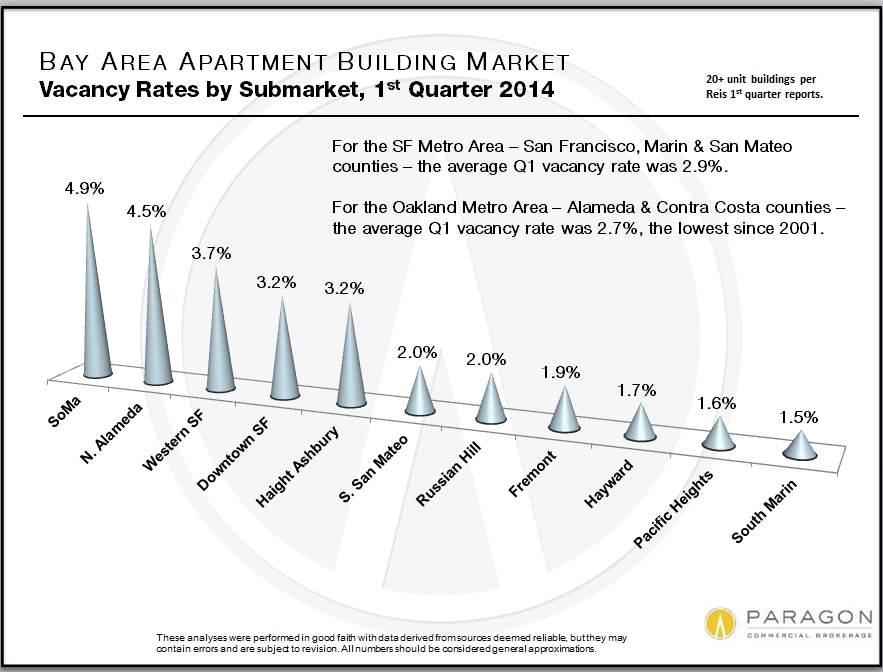

The economy continues to improve; population and employment to increase; rents to climb; and vacancy rates to decline. According to Reis, "Residential rents continue to grow fastest in the markets with the best underlying metro-level economies. San Jose, San Francisco, Seattle and Oakland-East Bay, all markets heavily influenced by the booming technology sector, were the top four markets by effective rent growth over the past twelve months." In the San Francisco and Oakland metro areas, gains in asking rents were recorded in all 19 submarkets, and Reis predicts further increases of 3.4% to 4.3% by year end.

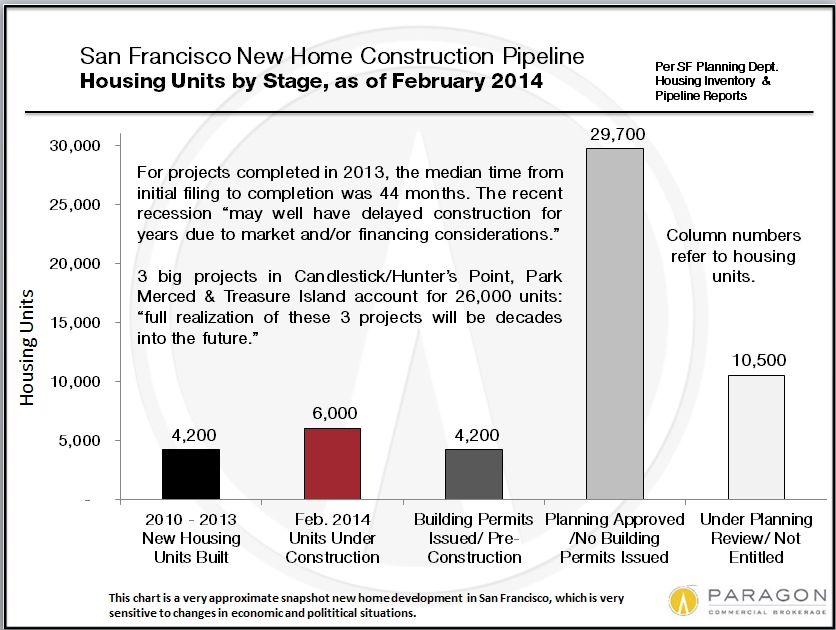

A good example of the general Bay Area housing dynamic is the city of San Francisco, where the upward pressure on rents has been most ferocious. According to the latest census data, the estimated increase in the city's population since 2010 was 32,000; over the same period, the number of employed city residents jumped by 56,000. But the number of new housing units added since 2010 was only about 4200. With an average household size of 2.3 persons, over 22,000 people have been looking for homes that don't exist, and this is probably the biggest driver of rent and home price increases.

For more information, please go to http://www.paragoncommercialbrokerage.com/

---------------------------------------------------------------------

For more news on San Francisco happenings, including news on real estate, global investments, local Bay Area news, please follow my Facebook page here.