Q3 2024 San Francisco Multifamily Report

Investor sentiment of the San Francisco Multifamily market continues to trend upwards.

San Francisco Multifamily Responds Positively to 50-Basis-Point Fed Fund Rate Decrease

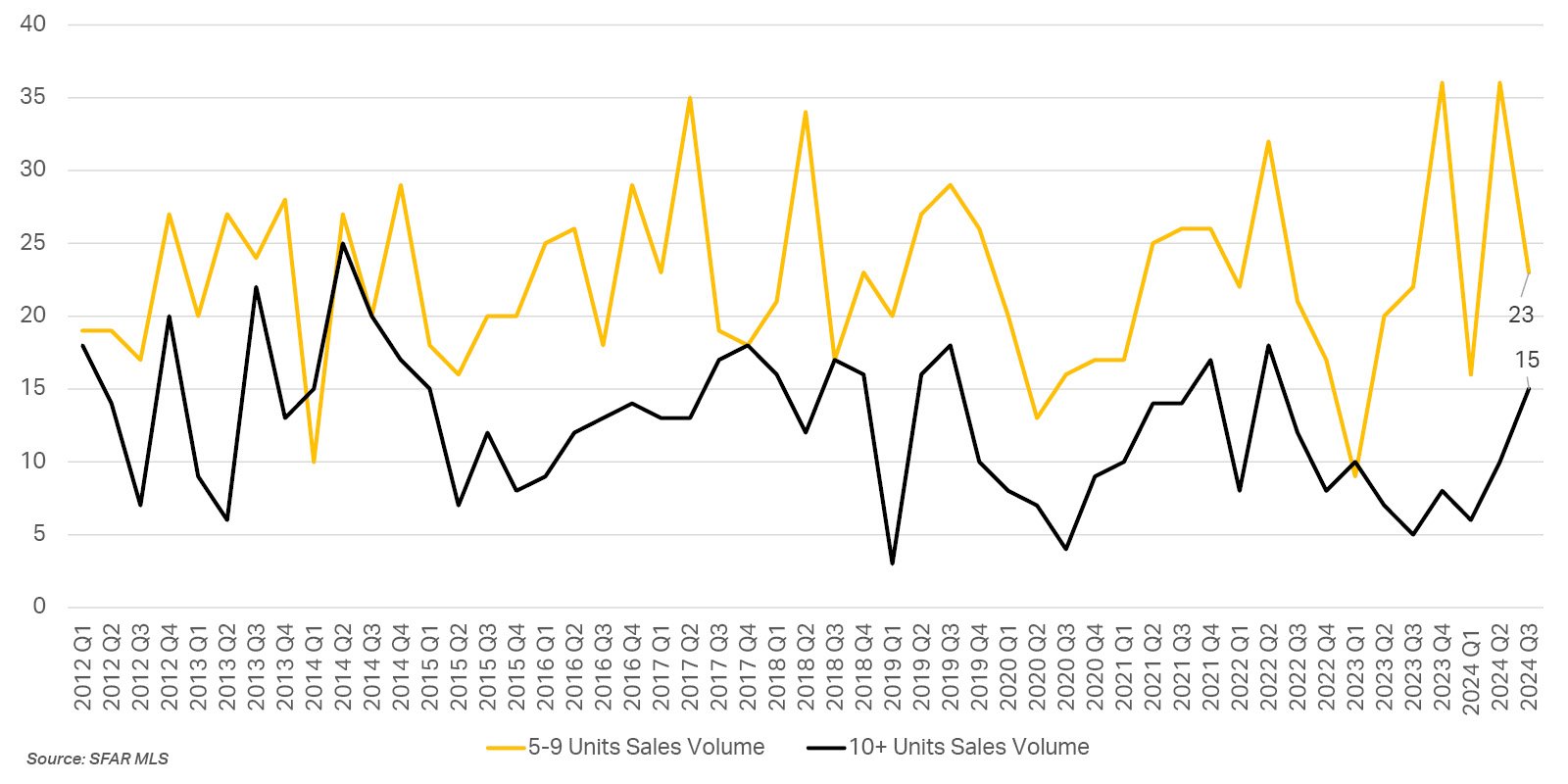

Q3 of 2024 was marked by a sustained increase in market optimism. This positive momentum continued over from the second quarter, following the Federal Reserve’s decision to finally implement the rate decreases they have been signaling; a 50-basis-point reduction in September. There has been a more than 50% increase in transaction sales involving large assets (10+ units) on a quarter-over-quarter basis, while capitalization rates have remained stable. Investor sentiment is surging toward critical mass, suggesting that the pace of the market’s recovery is poised to accelerate in the coming months.

District-by-District Analysis - Trailing Twelve Month Average/Total as of 10/1/2024

Cap Rate | $/SF | Total Transactions - 5+Unit Multifamily Properties - Source: SFAR MLS

5+ Unit Properties - Average $/SF | Cap Rate | GRM

5+ Unit Properties - Sales Volume

Multifamily Vacancy Rate & Average Asking Rents

Transaction Volume and Active Listings

Federal Funds Rate, 30-Year Mortgage Rate, 5-Year Treasury, and 25-Year SBA504 Loan Rate

This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass and LL CRE Group disclaim any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass/ LL CRE Group does not provide such advice. All opinions are subject to change without notice. Compass and LL CRE Group makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.

Contact us for more market information or multifamily investment portfolio consultation

Brian Leung

Senior Vice President

Lic. 01203473

415 278 7838

Brian@LL-CRE.com

Jeremy Lee

Senior Vice President

Lic. 01951309

415 988 9719

Jeremy@LL-CRE.com

Carla Pecoraro

Associate

Lic. 02019669

415 312 8901

Carla@LL-CRE.com

Chris Leung

Associate

Lic. 02194279

415 828 9108

Chris@LL-CRE.com